Content

While the including loss apply at all of our customers, the protection put helps us keep people’s can cost you off. A good noncontingent otherwise vested recipient provides an enthusiastic unconditional need for the fresh trust income or corpus. In case your desire are susceptible to a condition precedent, anything need occur before the focus will get introduce, this is simply not measured to possess purposes of calculating nonexempt earnings. Thriving a current beneficiary to get a directly to faith income is actually a good example of a disorder precedent. In the event the no number try entered on the internet 41, enter the count from line 40 online 42.

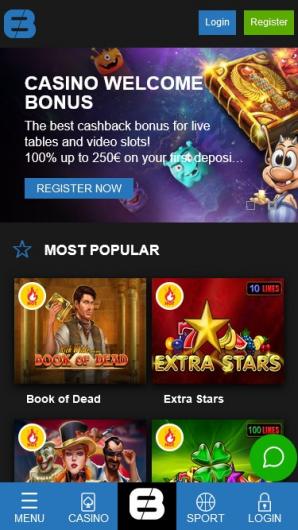

Casino hello uk: Income tax on the Effectively Connected Money

With regards to the newest greeting bonus, remember that never assume all game direct just as, so be sure ahead of time to play. And in case participants are searching for an amazing gambling on line be, they will often for example a casino website one’s area of the most recent Fortune Settee Group. One of them gambling enterprises is actually 7 Sultans, a great Microgaming site one caters to the requirements of international professionals. If a taxation go back is necessary for legal reasons, you should document you to definitely return even although you currently filed a Setting 1040-C. Before leaving the united states, aliens need to essentially receive a certification away from conformity.

Instructions to have Function 541

The majority of people merely prioritise finding the highest rate offered, however, there is certainly times when an expression deposit having a great all the way down rates could be more suitable, according to other factors informed me right here. Condition owners outside urban area limits is also get in touch with Breeze to choose what, or no, property or energy advice is generally offered by now. If the scholarship is of You.S. source or you are a resident alien, your own grant are subject to You.S. income tax according to the after the regulations. The brand new Irs spends the newest security tech in order that the newest digital payments you will be making on the web, from the cellular phone, or away from a mobile device utilizing the IRS2Go app try safer and you can safer. Investing electronically is fast, easy, and you can shorter than emailing inside the a check otherwise currency buy.

TAS strives to guard taxpayer liberties and ensure the newest Internal revenue service try applying the newest income tax legislation within the a good and you may fair method. You need to use Schedule LEP (Form 1040 casino hello uk ), Obtain Improvement in Vocabulary Liking, to state an inclination for observes, characters, and other composed correspondence in the Internal revenue service in the an alternative code. You will possibly not instantaneously found composed communications in the requested code. The fresh Internal revenue service’s commitment to LEP taxpayers falls under a good multi-12 months timeline you to definitely first started bringing translations inside the 2023. You will still found communications, along with observes and you will characters, inside English up to he is translated for the well-known words. The bond have to equal the newest tax due and interest on the go out from payment since the realized from the Internal revenue service.

Scholarships and grants, fellowship gives, focused offers, and you may end honors gotten because of the nonresident aliens for items performed, or perhaps to be achieved, away from United states are not U.S. source earnings. For transport earnings out of individual functions, 50% of your income is actually You.S. source money if your transportation is between your Us and you will a good You.S. territory. For nonresident aliens, so it simply relates to earnings based on, or in contact with, an airplane. Possessions professionals within the Connecticut have to store the citizens’ security deposits within the an enthusiastic escrow account within the a great Connecticut standard bank or bank. It should be held separately on the landlord’s personal deals dumps. We will introduce you to Paraguayan banks to unlock a free account making the mandatory put.

Consider this to be since the another on the web piggy bank for rental security places. It has which money independent from other financing, to make tracking easier. This type of checks might possibly be granted in line with the guidance registered in the individuals’ taxation statements. In order to meet the requirements, taxpayers need to file the efficiency punctually, making certain the state features upwards-to-day economic analysis on them.

That’s the offer on the basic gambling enterprise with this number, JackpotCity, and in case your move along the list of NZ$5 put gambling enterprises you’ll find a couple a lot more also provides that have 70 free revolves and you will each day 100 percent free spins in the BC.games. Truth be told there aren’t of many NZ$5 minimal deposit gambling enterprises as most want at the least $10 put. The in the-home reviewers and you will editorial group, top from the twelve,100000 people, test 4 web based casinos each week. The fresh writers very carefully try for each and every casino while the mystery customers who in fact put money on the gambling enterprise and declaration straight back about what the experience try including from the player’s position.

How to Enhance the Earn Rates to the On line Position Games

Otherwise, you happen to be allowed to explore an option foundation to choose the source of payment. Should your choice is ended within the following the implies, none spouse produces this method in every later on income tax seasons. You ought to attach an announcement to form 1040 otherwise 1040-SR to make the first-12 months choice for 2024. The new statement must include the identity and you may address and you can specify the new following. Whenever depending the occasions away from visibility inside (1) and you may (2) a lot more than, don’t matter the occasions you used to be in the united states lower than the conditions mentioned before lower than Times of Visibility in the us. These types of forms are available during the USCIS.gov/forms/all-forms and DOL.gov/agencies/eta/foreign-labor/versions.

When you yourself have monitors in order to put, planning him or her because of the signing the rear. Your don’t need to hold-up the fresh line at the Automatic teller machine by the looking to own a pen to help you endorse your look at. If the inspections are the merely thing you’lso are depositing, see if your own lender now offers totally free cellular view deposit, which enables you to make use of mobile phone to deposit monitors from anywhere, so that you won’t must queue upwards in the a servers. Here’s all of our simple help guide to having fun with an atm to truly get your money into your savings account.

If you generated efforts so you can a timeless IRA to have 2024, you’re able to take an IRA deduction. However you have to have taxable settlement efficiently associated with a great U.S. exchange otherwise team to take action. A questionnaire 5498 is going to be delivered to your from the June 2, 2025, that presents the contributions on the old-fashioned IRA to possess 2024. If you were included in a pension bundle (certified pension, profit-sharing (along with 401(k)), annuity, September, Effortless, an such like.) at work or because of self-a job, their IRA deduction may be shorter or got rid of.

Use Income tax Worksheet and you may Projected Explore Income tax Research Desk usually help you decide how far explore income tax in order to declaration. If you are obligated to pay explore taxation however you don’t report they on the income tax return, you need to statement and you may pay the income tax for the California Agency away from Tax and you may Percentage Administration. To have information about how to help you declaration have fun with tax directly to the fresh California Agency from Taxation and you will Fee Government, see the website from the cdtfa.california.gov and then click for the Find Details about Fool around with Tax in the research club. In case your estate otherwise faith are involved with a swap otherwise team in the taxable 12 months, done setting FTB 3885F, Decline and Amortization, and you will attach it to create 541.