Blogs

Along with, Russia’s invasion from Ukraine and you may a prospective redrawing of your own international trading maps features set extra strain on the fund’s overall performance. Traders is actually surely bringing the extra geopolitical dangers of development regions into account. Observe exactly how one affects you inside the bucks and feel, i consider “easy deals calculator” from the BankRate.com. But, for many who tinkered as much as — and that produces taxation and exchange costs — you’ll only earn typically 5.35%, considering Odean’s research. Yes, you have got to appear and you will faithfully toil at the office. But when you save and dedicate, you’re best off getting a passive.

David Swensen Profile (Yale Design) Comment and ETFs To utilize

The most name—the couch Potato—means inactivity, idleness, actually sloth. You only make a good varied profile away from 3 or 4 index mutual financing or exchange-traded money (ETFs), check in involved annually, and you will if not allow your money thrive to the safe neglect. (For many who’re fresh to the methods, his explanation observe I became an inactive.) Usually, 1000s of our subscribers discovered victory and you will comfort on the Inactive. There’s a catch-22 up against of numerous perform-be buyers one to’s staying her or him from the business. For the one hand, they think it do not have the economic training to deal with their own investments with full confidence. At the same time, it don’t have to have confidence in the advice available with monetary advisors, who will often have an excellent vested interest in attempting to sell products that pay her or him the largest administration otherwise trading charges.

You learn that the fresh ETFs features a management percentage from 0.35% a year (which works out to $105 in your $29,one hundred thousand money), when you are directory fund will definitely cost 0.70%, or $210 a year. All that said, there is certainly often hardly any cost to help you adding you to inflation shelter, according to the thing i find in my research. Along with extremely periods between the 70s and now, adding silver, commodities and REITs since the enhanced the newest efficiency away from a balanced collection. Along side longer term, the new BMO Balanced profile introduced a yearly go back of five.9% yearly, in place of cuatro.7% for the cutting-edge design. We could possibly anticipate the newest core design in order to surpass inside a good disinflationary several months, or whenever rising prices is certainly caused by in check. Whenever we stay in a keen inflationary or stagflationary ecosystem, the brand new advanced inactive design is always to outperform the new center collection.

Within the Limits One-Admission ETFs

Their chairman in the early seventies automatic the notion of the newest “monkeys throwing darts” profile. The guy utilized a great mainframe to produce at random chosen portfolios, and therefore the computers do review their overall performance, and that are wrote while the a webpage in the Wall structure Street Journal. I would consider personal money against these posts, and a lot have been constantly underneath the 50th percentile of the at random picked profiles. And, there’s no need to exit your own safe place – you might enjoy anywhere! There are also loads of other reasons to buy the Sofa Potato position since your go-so you can cellular slot. To begin with, the newest nuts signs always shell out inside the multiples from about three, so that they’re great for creating huge wins whilst you’re on your way to work otherwise university.

Couch potato Collection ETF Cake to possess M1 Money

This is how is the production for the profile assets on the same several months. Here you will find the output to your individual possessions on the months. The maps and dining tables in this article try thanks to portfoliovisualizer.com. Here’s the full go back (and dividends and you will dividend reinvestment) of January 2015 so you can Sep 2022. The time period for this evaluation will be based upon the brand new availableness of your real BMO ETFs.

- Bingley manage benefit from the characteristics of a charge-merely monetary coordinator, that will draft an investment street chart on her behalf to help you go after.

- Within the later years, otherwise even as we method the new retirement risk zone, protecting against close-identity rising cost of living threats is essential.

- Yet not, should your inactive collection will lose smaller, in addition, it gains smaller.

- To possess my spouse and you will myself, I keep gold, bitcoin, time holds, commodity brings and you will products within the modest numbers within our well-balanced gains portfolios, performing my very own sort of a just about all-climate collection.

But the basic idea is a two-asset, two-investment portfolio. So it old-fashioned inactive portfolio strategy invests in the Canadian carries, You.S. brings, around the world establish business stocks and Canadian securities using ETFs or directory common money. The brand new MoneySense “Greatest Inactive Collection Publication” suggests the countless means Canadian traders can access a couch potato profile. You don’t have to use exchange-replaced fund (ETFs) to hang a couch potato collection, however, ETFs are definitely more the most famous path to carrying out an excellent practical, low-percentage, global varied portfolio.

Let’s take a look at how the chair-potato model—setting 50% from finance for the S&P five hundred, 50% for the thread index, and you can rebalancing at the beginning of every year—might have did when it comes to the stock market. Andy Smith try an authorized Monetary Planner (CFP), authorized realtor and you will teacher with over thirty-five many years of diverse financial government feel. He could be a specialist to the individual finance, business finance and home and it has aided a huge number of customers in the meeting their monetary requirements more than his profession.

Ben Felix Model Profile (Rational Reminder, PWL) ETFs & Remark

How well does a passive financing collection create over the years? Take a look at just how inactive money create usually against their active fund alternatives. Yearly, of numerous fund often defeat its standards, and many does so for a few, five, or even ten years. The issue is one no-one can choose these types of profitable finance ahead, and you may prior overall performance doesn’t predict the near future. Assume we should invest $29,100 regarding the Global Couch potato collection and you also’re unsure whether to fool around with five ETFs otherwise five list fund.

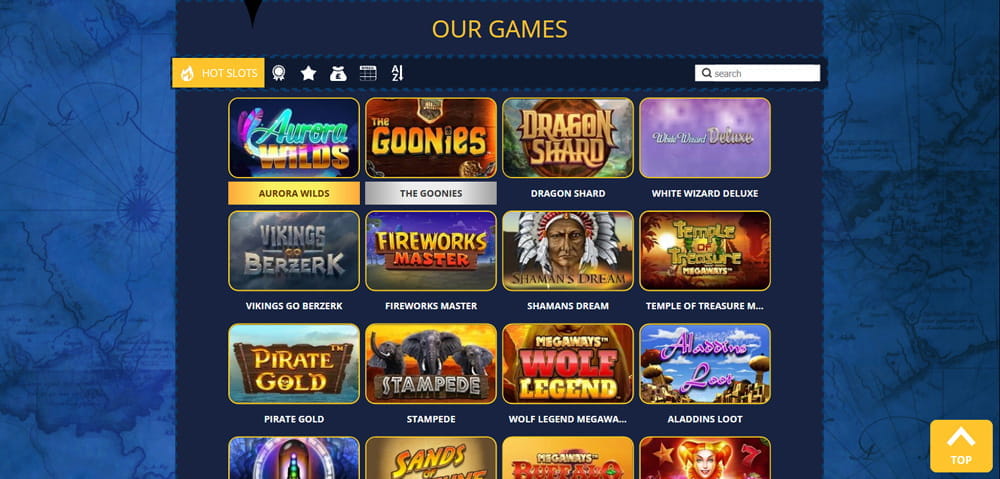

Couch potato Position

You might create the new five-ETF design using those people ETF business. Even with their modern lookup and features, Inactive spends a few of the eldest and you can best gambling formulas around. That being said, these formulas are well-customized and lead to a premier RTP (Go back to Player). Inactive’s RTP is amongst the higher of any on the internet position server in the industry. The sofa Potato position is determined in the an excellent classic-inspired gambling establishment having antique Las vegas-layout fluorescent lighting and deluxe carpet.

The sofa Potato’s Help guide to Taking Steeped

This method wouldn’t appeal to a person who’s searching for getting an even more productive investor and you will realizing close-term gains. You’re not and make changes to the profile seem to as a result in order to movements in the market. Yet not, that’s what you should do that have an active money method. Usually, that have an inactive collection form your register after an excellent 12 months to make modifications as required. Scott Burns, a personal finance creator, created the Couch potato Using Method within the 1991 instead for individuals who had been paying money professionals to help you manage their investments. Couch-potato profiles are low-to-zero maintenance and you will cheap and they require limited time for you to install.

The new jackpot prize getting about three wilds for three gold coins is actually 15,100 gold coins. However you only heard people say “That is a trader’s market! Get and you may keep try inactive!” Uncover what they have been attempting to sell. Yet not, in case your passive profile manages to lose reduced, what’s more, it development quicker. Studying the ten-seasons several months 2010–2019, the fresh S&P five hundred has returned a dozen.97% and the couch potato profile 8.48%. By October 2019, the brand new S&P is up 19.92%, while the passive are preparing in the 11.06%—scarcely brief carrots, however, a serious slowdown still.